Marketing is an essential part to grow any type of business. However, since every marketing strategy is an investment, we know the first question many business owners ask is, “what’s my ROI going to be?”

While ROI is certainly important, understanding and calculating your customer lifetime value (CLV) is equally if not more important.

No matter what type of business you are doing, calculating the lifetime value of your customers should be one of your top priorities. We have provided a quick and easy to follow guide for your business to learn more about who you’re serving.

What is Customer Lifetime Value (CLV)?

Customer Lifetime Value, or CLV, is a metric of how valuable a customer is to your company represented by the total amount of money a customer is expected to spend in your business during their purchasing lifetime.

For example, a person who loves buying BMWs will have a CLV of over $100,000 if they buy a new car every few years.

It’s important to understand that marketing is all about introducing new customers to your business and then RETAINING those clients, thus making the CLV extremely important.

Many times business owners may only look at the profit margin for each individual sale that a marketing campaign brings in. While that is necessary to understand, this is where we come in to educate business owners about focusing on the CLV.

Why is Customer Lifetime Value (CLV) Important?

As we mentioned, as a business owner you have to know how well your marketing strategies are doing. To know this, you need to understand CLV to create effective marketing plans and make strategic decisions. Finding out what your CLV is for your business acts as a guide to how much you should be investing to retain current customers and to attract new ones.

In theory, think of your business as a bucket filled with water. The water in the bucket represents your current customer base. When you grab a hose to put water in the bucket, that represents new customers in your business. On the bottom of your bucket, there is a leak where water is going out, this represents the customers you are losing.

This analogy means in order for your business to grow, you either need to increase your new customers, or decrease the number of lost customers. Knowing your CLV will help you strategize how to do that.

4 Variables You Need to Know Before You Look At CLV

There are some variables that you need to know in order to start calculating your total CLV for your business. Learning about these variables will give you a more accurate view on your business tactics and strategies.

1. Average Order Value (AOV)

The average order value is the time spent on your site with each new order processed. Knowing this metric can help your business decide whether to increase order frequency or average order value.

To find your average order value, use this formula:

Average Order Value = Total Revenue (365 days) Divided by Number of Orders (365 days)

2. Purchasing Frequency (f)

The purchasing frequency is also very important when consider the lifetime value of your customer. This formula tells your business how much a customer will purchase from your business in a certain period of time.

Understanding the purchase frequency can give you a better indication as to if your customers are returning. The more purchase frequency you have means your company will grow at a faster rate.

3. Customer Value (CV)

Customer value is the customer’s average order value (AOV) multiplied by their purchase frequency (f). This will give the total value of the customer.

4. Customer’s Average Lifespan (t)

Although Customer’s average lifespan may be the hardest to calculate, it is considered to be a very important data point. A customer’s average lifespan is the average time a customer remains active before they stop interacting with your business. For example, if a customer’s first purchase and last purchase was 45 days, then that means the customer’s average lifespan is 45.

How do you Calculate Customer Lifetime Value (CLV)?

In simple terms, the most basic formula for calculating customer lifetime value is as follows:

CLV = annual profit contribution per customer (CV) X average number of years as a customer (t)

Multiplying your customers annual value by how long their average lifespan is will give you the customers lifetime value.

This is one of the most important numbers to know for your business because it can tell you how much you should be spending to acquire new people. It also helps in knowing how much you should pay to retain them as a customer.

Calculating customer lifetime value doesn’t have to be hard. The average order value explains how much is spent at your business when each purchase is made. Looking into your AOV is essential because whether it gives you an idea of whether you should be increasing your order frequency or average order value.

It’s important to note that different businesses have different customer lifespans. A reasonable timespan for customers to remain active is 1-3 years.

Segmentation and Margin

To add more meaning into your customer’s lifetime value, you can include the margin you are going to see over the course of the shopper’s life. This means that your business can know both the actual profit and gain form each new customer and the revenue you receive.

The formula including margin is:

CLV = Average Order Value (AOV) X Purchase Frequency (f) X Margin (m)

Segmentation on the other hand divides your customers into more specific characteristics. This can be very helpful in allowing your business to see how profitable different types of customers are in your store.

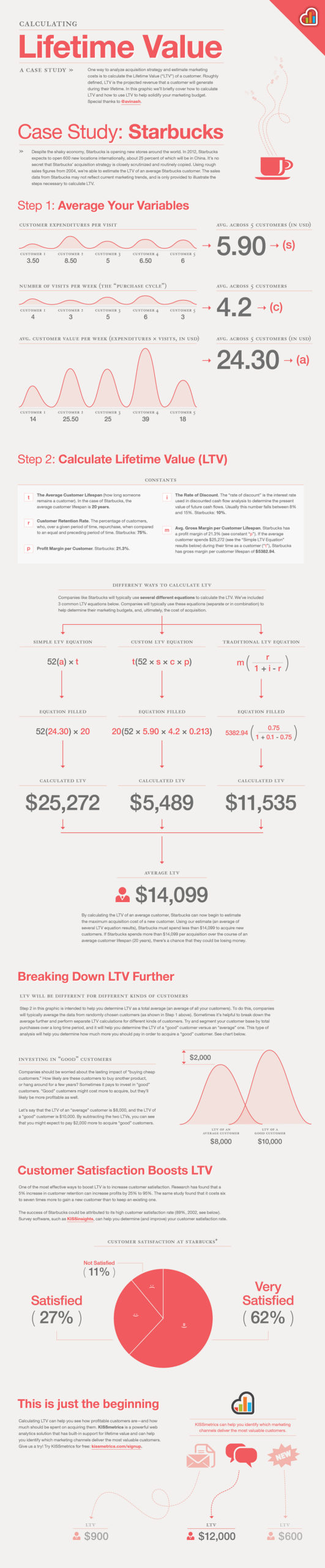

To learn more about calculating lifetime value, check out the infographic of Starbucks CLV.

Other Benefits of Knowing Your CLV Metric

Tracking lifetime value can help predict how your business will do in the future. If your lifetime value is growing alongside steady marketing strategy signals, this means your business growing more profitable and your marketing efforts are paying off.

Customer Retention

The more value you bring as a business, the more likely it is for your customers to go back to do business with you. This is incredibly important to growing your business and increasing your profit. Having a high customer retention rate can be due to great customer service, outstanding price, creating a warm atmosphere, and having the right marketing strategy. As a business, you should always strive to bring your customers unmatched value of your product and service.

Conclusion

As we said earlier, knowing your ROI is certainly important but just as important is understanding how to calculate your CLV. Your CLV gives you a better understanding of both current and future success as well as being an indicator as to what changes you should make and what your cost per customer acquisition should be.

If you’re interested in getting a better understanding about how CLV works or want to find the right digital marketing agency to help your business grow, contact us.